does nh tax food

While New Hampshire does not collect a sales tax excise taxes are levied on the sale of certain products including alcohol cigarettes tobacco and gasoline. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax.

Sales Tax Treatment of.

. Prepared Food is subject to a. 1m9fakbx Rkyhm 1800 per 31-gallon barrel or 005 per 12-oz can. DOJs first course of action will be to make sure this is a legitimate request.

Are charged at a higher sales tax rate. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. How does New Hampshire make money.

New Hampshire Catholic Charities DBA the New Hampshire Food Bank is a 501c3 nonprofit organization 02-0222163. A 9 tax is also. New Hampshire currently taxes investment income and interest.

Is it cheaper to live in Vermont or New Hampshire. Does nh tax food. For all intents and purposes however the Granite State does not have a state.

Sales tax rate Exemption status Food Prescription drugs Nonprescription drugs New Hampshire. Does Nh Have Food Tax. Does nh tax food.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes. Does New Hampshire have food or sales tax. Does Florida have food tax.

State sales tax rate. Since no goods or services were provided in exchange for your. Grocery food is generally tax exempt in Florida.

Please note recently enacted legislation phases out the Interest and. The tax is 625 of the sales price of the meal. Accordingly New Hampshire is listed as NA with footnote 11.

What is the New Hampshire state income tax rate. A 9 tax is also assessed on motor vehicle rentals. Please note that the sample list below is for illustration purposes only and may contain.

No state sales tax. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. This is a flat 5 individual rate.

Does Nh Have Food Tax. The tax should be applied to the sale amount after the. No state sales tax.

Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9 to 85. State sales tax rate. Does nh tax food.

The tax rate depends on the year. 53 rows Table 1. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

The 2017 maximum benefit permitted for an eligible household of three with no net income is 511 per month which is approximately 549 per person. 107 - 340 per gallon or 021 - 067 per 750ml. Does Nh Have Food Tax.

Does nh tax food. New Hampshire is actually in the process of phasing out the interest and dividends tax. The Florida Department of Revenue provides a list of general groceries in Publication DR-46NT.

No state sales tax Maine. Please note recently enacted legislation. We include these in their state sales tax.

The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax.

Why Are Minnesotans So Overtaxed American Experiment

With No State Income Tax Where Does Texas Get Its Money Curious Texas Investigates

The Most And Least Tax Friendly Us States

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

New Hampshire Sales Tax Rate 2022

Sales Tax Laws By State Ultimate Guide For Business Owners

2022 Property Taxes By State Report Propertyshark

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Tax Rate Changes For 2022 Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Data Dive Which States Tax Groceries Mississippi Today

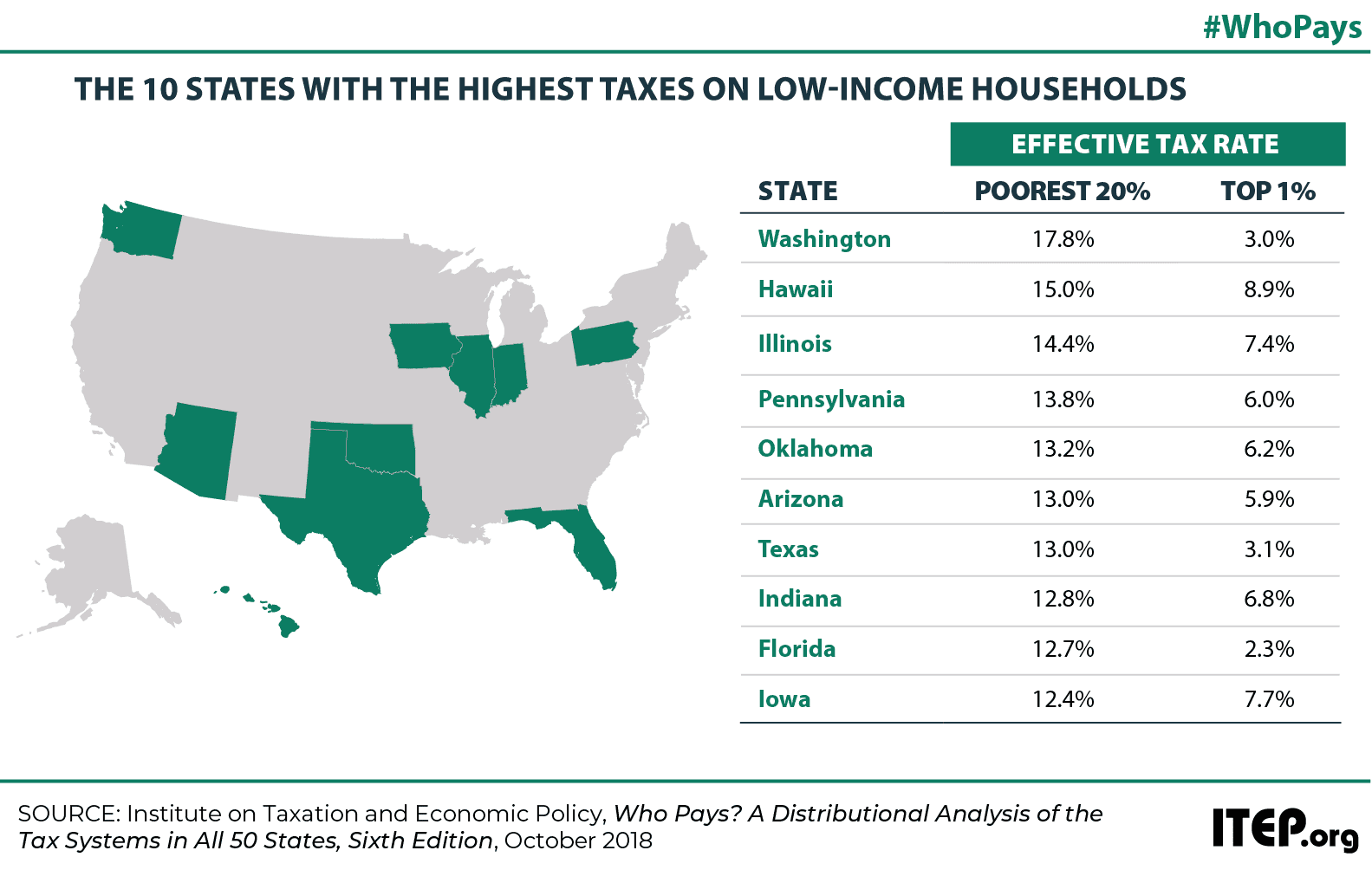

The Staggering Unfairness Of Our State Tax System

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

General Sales Taxes And Gross Receipts Taxes Urban Institute